Guide to Profitable Sales

Purchase Intent

Measurement

The key to measuring purchase intent is to assure a proper stimulus. In an ideal fantasy world this would be the actual product with full explanation of all use benefits clearly elaborated and a price with any adjustments provided. With a new product we back down from that and show a fully developed advertisement or even a concept statement; but we never back down from showing the price. This is because price elasticity is likely an important decision influence is intent choice. In more sophisticated research we often include multiple price points being tested, any price discounting actions like coupons, BOGOs, etc. We even can consider using filter questions for store location adjustments by asking respondents their typical shopping aisle section visit behaviors.

What we ask after showing the stimulus is an intent to purchase question with this type of response scale.

Top Two Box

It is common for organizations to establish hurdle rates for what percent of the survey respondents answer in the Very or Probably will buy Top Two Box answers. In fact, this can be an important criteria in a Stage Gate decision to proceed process. That may make sense for an organization which has an organization advantage or skill in distribution through the Food/Drug/Mass Merchandise channels to a general population buyer set which they can’t sort out very easily at point of purchase. However, for many other types of businesses they have the potential to more directly speak to and deliver to highly targeted populations. In those types of businesses it makes more sense to include very carefully considered demographic and list source targeting questions in the survey of purchase intent and simply align the top intent to purchase questions to these. Then you create an advertising and promotion strategy aimed effectively and efficiently at the most receptive.

Revenue Projection

So you think you can just take the percent of people who say they will buy times the count from the underlying potential times the price of what you offer and project your revenue. Then conclude “I will be RICH”.

Time to burst your bubble. A couple things get in the way of that simple logic.

Lie Factor

There is a hint of an issue from the fact we ask a five level purchase intent question; people who say “definitely” must count more than the “probably”. Yeah, well in the real world not even all of the “definitely” people will actually make a purchase. We can conclude that people lie on surveys…

It is actually pretty interesting that the follow-through rate from these purchase intent answers differs by country and product category. Think about the stories you have heard about how different people from various countries show difference in how polite they are. Some groups regard telling you that your product kind of sucks as being impolite and the response scale in such countries scales up to higher intent to purchase but less follow-through. There are also differences by category because some things are considered more personally sensitive than others. It is one thing to tell someone their beautiful lipstick is nasty versus indicating I simply am not a fan of spicy food. Don’t believe this? There is a company who has made a whole business model out of establishing adjustment norms by country & category.

So what do you do if country/category norms aren’t available for the type of good or service you plan to offer. Our starting point is that about 86% of those who answer that they will ‘definitely’ buy will follow-through in the real world. Of those who say they ‘probably’ will buy we would apply the follow-through rate of only 29%. The ‘might or might not’, ‘probably not’ and ‘definitely not’ are given zero’s for actual purchase estimation. Sometimes we aim to tighten up these general adjustment factors by injecting an internal study norming approach in the study design. This requires for also accounting for the other factors discussed below in our modeling; including awareness measurement within the survey and having sources for actual distribution. The basic logic is to include an existing product(s) in the same survey as the new product and work the simulated test market model backward to match the known sales of the existing product. The key to the math solution is that those answering ‘definitely’ will be valued with a three fold weight factor compared to ‘probably’ respondents. This recognizes the relative strength of commitment to actual purchase seen from survey intent to purchase statement responses.

Know about it

You have to know about something to want to buy it; that is having awareness. In a purchase intent survey, all of the respondents who answer the question know about the product/service from the stimulus presented. That means your respondents to the survey have 100% awareness. There isn’t a product or service on the planet that actually has 100% awareness in the real world. Most companies would be ecstatic if it was 70% of their target audience and most have way, way less.

So your math in converting purchase intent results to revenue has to be adjusted for the percent of your target who has awareness of it. There is a big debate about whether it is better to use “aided” or “unaided” awareness. Unless you are absolutely sure you have an ‘impulse buy’ item that is distributed in a highly visible way at its point of distribution, please use “unaided” awareness in this calculation adjustment.

Find It

To buy it, you need to be able to find it; what is and where is your item’s “Distribution”? In the world typical of Food/Drug/Mass Merchandise products, this measurement is done with an ACV (All Commondity Volume) measure of distribution. This sounds fancy but just think of it as a way that one accounts for the fact that all stores don’t have equal traffic or eyeballs going through their aisles; it adjusts distribution for consumer count.

The basic math is straight forward in that you adjust for the percentage of stores that carry your item if that is how you distribute it. If you sell on-line you don’t need to adjust this because they see and buy your product sort of side-by-side. If your item is in only 10% of stores, you can knock 90% of the volume off your prior calculation to get your answer. To be fair, there are some potential reasons for modifiers on this adjustment. For example, if we know your buyers from confirming direct research say they will visit several stores to find it, you might not knock it down as far; but rememeber the ‘lie factor’ before you get carried away. You also see products being very clear right in their advertisements with statements like “Can be found at…” when they have low overall distribution.

Important side note: One of the biggest causes of failures in a new product launch is not coordinating the media plan with the distribution availability.

Simulated Test Market

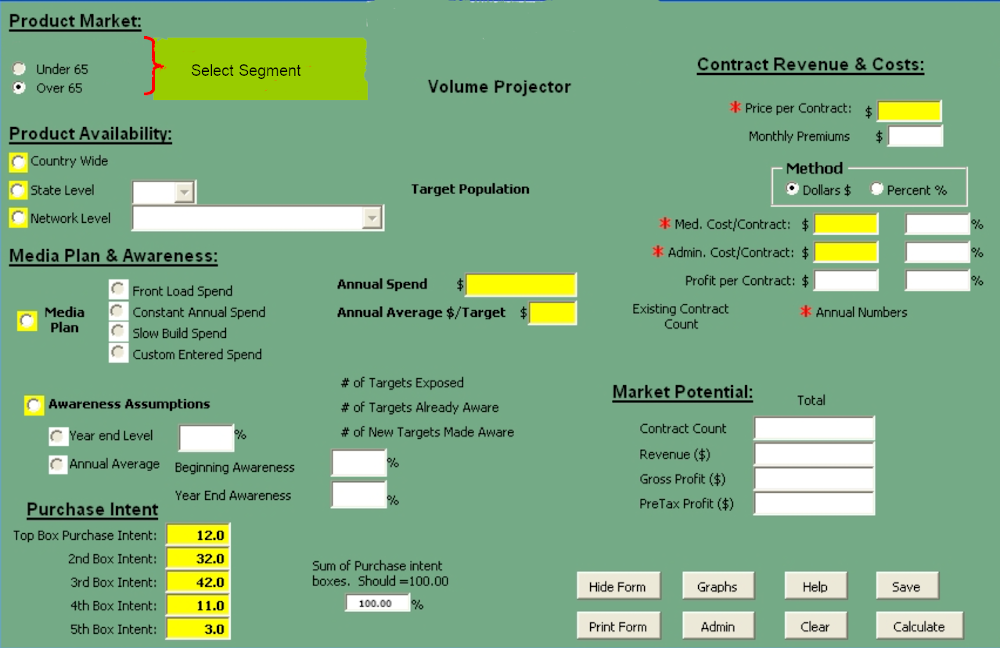

You can put all these parts together, even uniquely tuned to your product/service market situation, in what is know as a simulated test market (STM) What the actual STM development adds beyond the purchase intent measure is volumetric scaling. This means the ability to project the survey findings into to an estimate of contracts, revenues, and total profit. The STM tool will relate survey findings to market demographics and network geographic information in this projection process. The result will be a prototype database with a simple to use “what if” front-end that will allow performance scenario estimates to be projected and refined.

The real advantage of a Simulated Test Market model approach is that you can run scenarios. You might adjust the target segment you are going after. You might adjust which state or states you will be doing business in. You might look at how your advertising plan time alignment might be adjusted. You might look at how your price elasticity interacts with your purchase intent scores to fine the volume optimization point. You might look at how your Cost of Goods Sold (CGOS) plays out against your price point to find the profit optimization point. We have even built models where market-by-market, store-by-store distribution build by calendar date has been modeled and aligned the subsequent Trade Sales Force objectives via their incentive compensation plans.

Example Methodology

The specific methodology is adapted to the product/service situation, market segment, and the additional measures needed in the Simulated Test Market modeling design. The model logic should be developed in protype before the survey research collection itself. You want to take mock output data from the survey data management plan output and test drive it for the analytics of the model. This needs to be totally buttoned down because the expensive part is collecting the survey data and you probably won’t get a second chance.

General Design Flow

The general flow of the study design for this research project is anticipated to be –

I. Screener and Awareness Measurement via Phone.

Awareness of Company Awareness of specific product Screener by product for eligibility requirements for all respondents and confirming current product use for Control product calibration. Current Product Company and Product (for share calculation in internal control logic)

II. Mail the Concepts to be tested to respondents.

III. Phone Questionnaire Follow-up.

Five-point purchase intent scale Number of units would purchase (individual, spouse, etc) Six-point intensity-of-liking scale Five-point value-for-the-price scale Five-point new and different scale Diagnostics (strengths, weaknesses, attributes) Current Product Use (reconfirm or minimally link in from screener response to those will full survey record from follow-up questionnaire). Demographics: They being designed to carefully match secondary data sources for projection scaling and list sources for subsequent target marketing.

Screener and Awareness Questionnaire

The screener and questionnaires presented in this example are for an over-65 health care product. One would make the appropriate edits for different targets and product category.

Are you or anyone in your home age 65 or over?

___Yes ___No -> Thank and Terminate!

Which of the following statements best describes your personal involvement in the choice of health care coverage for you:

___ I am the decision-maker when it comes to health care coverage (CONTINUE)

___ I share health care coverage decisions equally with my partner or spouse (CONTINUE)

___ I share decisions with my partner or spouse, but I am the primary decision-maker (CONTINUE)

___ We share decisions, but my partner or spouse is the primary decision-maker (ASK TO SPEAK WITH DECISION-MAKER OR TERMINATE)

___ I am not at all involved in the decisions regarding my health carecoverage (ASK TO SPEAK WITH DECISION-MAKER OR TERMINATE)

___ Don’t Know/Refused (TERMINATE)

Are you or anyone in your family employed by –

___ An advertising agency or the advertising department of a company

___ A Marketing Research Firm or the marketing research department of a company

___ A company that publishes a magazine or newspaper

___ A company that operates a television or radio station

___ An Health Insurance Company or firm that sells health insurance

___ A Hospital Management company

___ A health care provider such as a physician, hospital, nursing home,

medical clinic, or other type of health care product

If employed by any listed, Thank and Terminate! Otherwise continue.

Please tell me the name of the Health Insurance Company which first comes to mind? What other Health Insurance companies are you aware of? (Probe: Have you ever heard of (READ LIST)?

First Unaided Aided

___ ___ ___ Aetna

___ ___ ___ Anthem

___ ___ ___ Blue Cross/Blue Shield

___ ___ ___ CIGNA

___ ___ ___ Harvard Health Plans

___ ___ ___ Humana

___ ___ ___ Kaiser

___ ___ ___ United Health Care

___ ___ ___ Wellpoint

___ ___ ___ Other: _______________________________

(Specify)

Now I would like to ask you about specific Health Insurance Products offered by various companies. Have you ever heard of the following?

Test Product(s) (ghost measure calibration)

Control Calibration Product

Competitor Product(s) around both the test and control

Bogus product(s) to gauge the error band of false awareness

Are you currently covered by some type of health insurance, or not?

___ Yes

___ No, Skip to Q????

Which of the following best describes the type of health insurance you have?

___ Medicaid

___ Medicare only

___ Medicare supplement

___ HMO

___ Some other type of health insurance

What company currently provides you Health Insurance coverage?

___ Aetna

___ Anthem

___ Blue Cross/Blue Shield

___ CIGNA

___ Harvard Health Plans

___ Humana

___ Kaiser

___ United Health Care

___ Wellpoint

___ Other: _______________________________

Can you tell me the name of the specific product you have with (insert company from Question X)?

___ YES, Record Product Name ______________________________________

___ NO

I am going to ask you about the Product Features of your health insurance product and would like you to tell me about those you know. For those you don’t, simply say I don’t know.

Your Plans Co-pay for a routine doctor visit $_____________, Don’t Know

Your Plan’s Co-pay for an emergency room visit$_____________, Don’t Know

Your Plan’s Co-pay for a hospitalization $_____________, Don’t Know

Your Plan’s Individual Deductible amount $_____________, Don’t Know

Your Plan’s Family Deductible amount $_____________, Don’t Know

If your plan covers drug benefits? ___ Yes, ___ No

If your plan covers vision benefits? ___ Yes, ___ No

We will be mailing you an envelop with some additional materials for a follow up set of questions. It should be there within a week. Can you tell me a good time to reach you for a few final questions about reaction to the materials in that envelop? Set Date: ______________ Preferred Time(s): _________________

In the Envelop

We are sending the eligible respondents concept statement or ads for a subsequent phone survey follow up of the concept test evaluation portion of the study. There is an outer envelop for postal mailing requirements. There is an inner master envelop with the statement below printed on its outside. Within that master envelop are smaller envelops which contain a code like “A”, “B”, “C”, etc. so the respondent can be instructed to open a specific one and you will record which as the interview commences. Within each smaller inner envelop is a stimulus in concept statement or full advertisement form for them to read just before you proceed with the interview about it.

Concepts Mailed in Envelop with the following statement imprinted on the outside

___________________________________________________________________________________________________________________________________________________________

By opening this envelop to participate in the following survey for _________ Research, you hereby agree to keep all information about the survey, including the products and concepts being tested, completely confidential and further agree not to disclose such information to any other party nor to attempt to copy, print, record, or download any information from this survey. As to members of your household, you agree that they are also under this same obligation of confidentiality. ___________________________________________________________________________________________________________________________________________________________

Measure Concept Reaction

After the respondent recieves the envelop with the concept(s) you want to measure you they will recieve a phone call with instructions to open one of the internal envelops in the mailed set, given a few moments to review it, and asked these questions